Accounts

Free Trial

Projects

SSL

Storage

Domains

Sub-domains

Your Text

Your Text

Your Text

Your Text

Your Text

Your Text

Your Text

STACK BANK

BACKGROUND INFORMATION

Quick Summary

- What Is The Stack Debit Card?

- How Does The Stack Card Work?

- Key Features of Stack

- How Much Does Stack Cost?

- The Stack Bank App

- Is Stack Safe and Secure?

- Advantages of Stack

- Disadvantages of Stack

- Conclusion – Should You Try Stack Bank?

What is Stack?

Stack is a prepaid Mastercard that originated in Canada. It can be used with an iOS or Android app so you can manage your money. Once you have loaded money onto your Stack card, you’ll be able to use it to pay for various products and services. One of the key benefits of using Stack is that you don’t need to pay a fee. You won’t be charged foreign exchange fees when you use Stack. This gives it a big edge over many other cards that will charge you at least 2% when you make a foreign transaction.

How does Stack work?

Load money onto your Stack card and use it in the same way that you would use a normal MasterCard. The ability to load money onto a separate card for specific types of purchases can prevent you from overspending. For instance, if you have a big night out planned, you can fund it with your Stack card without dipping into funds that are required for other purchases.

Stack is available across most of Canada, although you won’t be able to use it in Quebec. Prepaid cards have become increasingly popular over recent years for many reasons. You can’t go into an overdraft with prepaid cards, but they are accepted by most online and offline retailers. Stack is particularly suited to travelers seeking to save money on foreign transactions as you won’t be charged for foreign transactions. There are also various reward programmes to take advantage of if you’re interested in the partner products and services. You can also add money to your Stack card at various in-person locations, which is something most other prepaid cards don’t allow you to do.

A big advantage of opting for Stack is that it encourages you to save money. It does this by letting you put the change from each purchase you make towards a goal. You can select a specific amount for each purchase. For instance, if you have chosen a figure of $5 and you buy something that comes to $3, the overall cost will be $8. The extra $5 will be put towards your savings goal. You can

also use the app to track and analyze your spending to make better, more informed financial decisions.

Key features of Stack

- Load money onto card from another source

- Designed to help with savings goals

- Track and analyse your spending

How much does Stack cost?

You don’t need to pay anything to use Stack. This is one of the reasons why it has become one of the most popular facilities in its field.

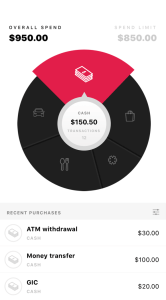

The Stack app

If your phone or tablet runs on iOS or Android, you should be able to download the Stack app to track your spending, set goals and manage your money.

Is stack safe and secure?

You will need to prove your identity before you can open a Stack account. You will need to wait for your card to arrive before you can set up your PIN. The first time you reopen the app, you will be asked for your app PIN. It’s important to note that the PIN for your card is not the same as the one for the app. If you do forget your app PIN, you can request a new one via the app. Money can be loaded onto your card via Visa debit, payroll direct load, cash load and Interac e-Transfer.

Advantages of Stack

- No foreign exchange fees

- Suitable for Android and iOS users

- Create savings goals

Disadvantages of Stack

- Only available in Canada

- Complaints about savings accounts being removed

- Discounts not relevant to everyone

- Your bank may charge you for Interac e-Transfers

Conclusion

Many Canadians partake in cross-border shopping, buying products not only from North America but around the world. This makes the lack of foreign exchange fees a big draw for many Canadian consumers. It is likely to be particularly useful to you if you’re a keen traveler. Stack may also be helpful if you need help with separating cash used for leisure from other funds, such as money you’re keeping for household bills.

The app has proved very popular with those who need help with tracking their spending, though some users have complained about glitches. Another cause of Stack’s popularity is that the annual fee is $0. You don’t even need to pay to withdraw cash from an ATM if you use Stack – aside from any funds that ATM company might charge you. Stack simply uses the Mastercard exchange rate to convert your foreign purchases to Canadian dollars.

The app has proved very popular with those who need help with tracking their spending, though some users have complained about glitches. Another cause of Stack’s popularity is that the annual fee is $0. You don’t even need to pay to withdraw cash from an ATM if you use Stack – aside from any funds that ATM company might charge you. Stack simply uses the Mastercard exchange rate to convert your foreign purchases to Canadian dollars.

Stack allows you to avoid many of the fees that you might associate with banks and other card companies. Nonetheless, you may still need a bank account to fund your card in the first place and could still be charged various fees there. Stack will give you a deep insight into how much you’re spending and what your funds are going on, but if you’re already highly adept at budgeting this might not be so appealing.

Another good reason to try Stack is that various digital wallet solutions are supported. These include Apple Wallet and Samsung Pay. Stack may also work for you if you regularly buy from the brands that the company are partnered with. If you buy from these brands using your card, part of the cash will be returned to your account in many cases. You may also earn a small bonus when you refer a friend.

The savings facility can also help you fund a big purchase or put cash aside for a more financially challenging time. Nonetheless, it’s important to remember that Stack is not a bank. This means you won’t be able to talk to someone about your account in-person and you won’t get many of the services a bank might offer you. Stack will not help you boost your credit score as you won’t be borrowing any money when you use it.

If you do make foreign purchases regularly and are looking for a new way to track your spending behavior, Stack may still be the right solution for you.